CORPORATE GOVERNANCE

Anti-Corruption & Anti-Bribery Policy

1. Objective

Mikro Msc Berhad (“Mikro”/Company) takes zero-tolerance approach to bribery and corruption and is committed to acting professionally, fairly and with integrity in all our business dealings and relationships, wherever we operate, and to implementing and enforcing effective systems to counter bribery. The purpose of this policy is to set out responsibilities of the management and those working for Mikro, in observing and upholding the company’s position on bribery and corruption and to provide information and guidance to those working for Mikro on how to recognise and deal with bribery and corruption issues.

2. Definition

Bribery is an offer of receipt of any gift, loan, fee, reward or other advantage to or from any person as an inducement to do something which is dishonest, illegal or a breach of trust.

3. Applicability

This policy applies to all individuals working for the Company anywhere in the world and at all levels and grades, including but not limited to senior managers, officers, directors, employees (whether regular, fixed-term or temporary), consultants, contractors, trainees, seconded staff, casual-workers and agency staff, volunteers, interns, sponsor, or any other person associated with us or any of our subsidiaries or their employees wherever located.

In this Policy, “Third party(ies)” means any individual or organisation, who/ which come into contact with Mikro or transact with Mikro and also includes actual potential clients, suppliers, business contacts, consultants, intermediaries, representatives, subcontractors, agents, advisers, joint ventures and government & public bodies (including their advisers, representatives and officials, politicians and political parties).

4. Policy Details

A bribe is an inducement, payment, reward or advantage offered, promised or provided to any person in order to gain any commercial, contractual, regulatory or personal advantage. It is illegal to directly or indirectly offer a bribe or receive a bribe. It is also a separate offence to bribe a government/ public official. “Government/ public official” includes officials, whether elected or appointed, who hold a legislative, administrative or judicial position of any kind in a country or territory.

A bribe may be anything of value and not just money, gifts, inside information, sexual or other favours, corporate hospitality or entertainment, offering employment to a relative, payment or reimbursement of travel expenses, charitable donation or social contribution, abuse of function and can pass directly or through a third party. Corruption includes wrongdoing on the part of an authority or those in power through means that are illegitimate, immoral or incompatible with ethical standards. Corruption often results from patronage and is associated with bribery.

Examples of bribery:

i) Offering a bribe – Antony, an employee of XYZ Company, offers a potential client, tickets to a major sporting event, but only if they agree to do business with XYZ Company. This would be an offence as Antony is making an offer to gain a commercial advantage. It may also be an offence for the potential client to accept Antony’s offer. Providing clients with hospitality is acceptable, provided the requirements, set out in section titled “Gifts and hospitality” are followed.

ii) Receiving a bribe – Arjun works in the Supply Chain Management Department in Zen Automobiles. A regular supplier offers a job for Arjun’s cousin, but makes it clear, that in return they expect Arjun to use his influence to ensure Zen Automobiles continues to do business with the supplier.

iii) Bribing a government official – Imran from Finance is asked to arrange for payment to be made to a customs official to speed up the administrative process of clearing our goods through customs.

5. Gifts and Hospitality

This policy does not prohibit normal, reasonable, appropriate, modest and bona fide corporate hospitality (given and received) to or from third parties if its purpose is to improve our company image, present our products and services, or establish cordial relations. Associates must also decline any invitation or offer of hospitality or entertainment when made with the actual or apparent intent to influence their decisions.

Gifts can occasionally be offered to celebrate special occasions (for example religious holidays or the birth of a child) provided such gifts are moderate in value, occasional, appropriate, totally unconditional, and in-fitting with local business practices. No gift should be given or accepted if it could reasonably be seen improperly to influence the decision-making of the recipient. In addition some types of gifts will clearly never be acceptable including gifts that are illegal or unethical, or involve cash or cash equivalent (e.g. loans, stock options, etc). Furthermore, by way of non- exhaustive example, the use of a customer’s holiday home, or an invitation to his/her family to join him on a foreign business trip, or the extension of a trip at the customer’s expense to include a holiday etc, are at all times unacceptable, and associates should not in any way indulge in such practices.

The No Gift Policy is to be used in conjunction with this Anti-Corruption and Anti-Bribery policy.

6. What is not Acceptable

It is not acceptable to:

i) Give, promise to give, or offer, a payment, gift or hospitality to secure an improper business advantage or to reward a business advantage already given;

ii) Give, promise to give, or offer, a payment, gift or hospitality to a government official, agent or representative to “facilitate”, expedite or reward a routine or other procedure;

iii) Accept payment from a third party knowing or suspecting it is offered with the expectation that it will obtain a business advantage for them;

iv) Induce another individual or associate to indulge in any of the acts or omissions mentioned in item 5 above;

v) Threaten or retaliate against another associate who has refused to commit a bribery offence or who has raised concerns under this policy; or

vi) Engage in any activity that might lead to a breach of this policy.

7. Charitable Donations

As part of its corporate social activities, Mikro may support local charities or provide sponsorship, for example, to sporting or cultural events. We only make charitable donations that are legal and ethical under local laws and practices and also within the corporate governance framework of the organization.

8. How to raise a concern

Every person, to whom this policy applies too, is encouraged to raise their concerns about any bribery issue or suspicion of malpractice at the earliest possible stage. If he/she is unsure whether a particular act constitutes bribery or corruption or if he/she has any other queries, these should be raised with their respective Manager and/or the Whistleblower contact personnel.

9. Policy Review

This Policy shall be reviewed periodically to ensure that it continues to remain relevant and appropriate.

Board Charter

1. INTRODUCTION

The Directors of MIKRO MSC BERHAD (“MIKROMSC”) regard Corporate Governance as vitally important to the success of MIKROMSC’s business and are unreservedly committed to applying the principles necessary to ensure that the following principles of good governance are practised in all of its business dealings in respect of its shareholders and relevant stakeholders:-

The Board is the focal point of the Company’s Corporate Governance system. It is ultimately accountable and responsible for the performance and affairs of the Company.

All Board members are expected to act in a professional manner, thereby upholding the core values of integrity and enterprise with due regard to their fiduciary duties and responsibilities.

All Board members are responsible to the Company for achieving a high level of good governance. This Board Charter shall continue and form an integral part of each Director’s duties and responsibilities.

This Board Charter is not a total document and should be read as an expression of principle for optimising corporate performance and accountability. The Board will review and update (if necessary) the Board Charter on an annual basis.

2. OBJECTIVES

The objectives of this Board Charter are to ensure that all Board members acting on behalf of the Company are aware of their duties and responsibilities as Board members and the various legislations and regulations affecting their conduct and that the principles and practices of good Corporate Governance are applied in all their dealings in respect and on behalf of the Company.

In pursuit of the ideals in this Board Charter, the intention is to exceed “minimum legal requirements” with due consideration to recognised standards of best practices locally and internationally.

3. THE BOARD

3.1 Role

3.1.1 The Board is in charged of leading and managing the Company in an effective and responsible manner. Each Director has a legal duty to act in the best interest of the Company. The Directors, collectively and individually, are aware of their responsibilities to shareholders and Stakeholders for the manner in which the affairs of the Group are managed.

3.1.2 The Board meets in person at least once every quarter to facilitate the discharge of their responsibilities. Members of the management who are not Directors may be invited to attend and speak at meetings on matter relating to their sphere of responsibilities.

3.1.3 Duties of the Board include establishing the corporate vision and mission, as well as the philosophy of the Company, setting the aims of the management and monitoring the performance of the management.

3.1.4 The Board assumes the following specific duties:-

(a) To review and adopt strategic plans for the growth of the Group;

(b) To set policies appropriate for the business of the Group;

(c) To oversee the conduct of the Group’s business and to evaluate whether the business is being properly managed;

(d) To approve annual budget;

(e) To set and review budgetary control and conformance strategies;

(f) To monitor management performance and business results;

(g) To identify principal risks and to ensure the implementation of appropriate systems that encourage enhancement of effectiveness in Board and management;

(h) To keep pace with the modern risks of business and other aspects of governance that encourage enhancement of effectiveness in Board and management;

(i) Succession planning, including appointing, training, fixing the compensation of and where appropriate, replacing Board and key management;

(j) Be accountable to the shareholders to ensure the Group has appropriate corporate governance that operates efficiently and transparently;

(k) To set and review and approve annual reports to the shareholders; and

(l) To review the adequacy and integrity of the Group’s internal control systems and management information systems, including systems for compliance with applicable laws, regulations, rules, directives and guidelines.

3.2 Board Structure

3.2.1 The Regulations governing the management of MIKROMSC are found in the Company’s Articles of Association which stipulates among others, the appointment and number of Directors, the election of a Chairman of the Board; who will preside at all Board meetings, the appointment of CEO/Managing Director and rotation of Directors, etc.

3.2.2 Although the Board is made up of a variety of Directors with different roles and responsibilities, there is no distinction in their accountabilities to the Company.

3.3 Composition and Board Balance

3.3.1 The number of Directors shall not be less than 3 and not more than 12 unless otherwise determined by a General Meeting, as stipulated in Article 82 of the Company’s Articles of Association.

Board of Directors of MIKROMSC

| Name | Designation |

| Datuk Aznam Bin Mansor | Non-Independent Non-Executive Chairman |

| Yim Yuen Wah | Managing Director |

| Goh Yoke Chee | Executive Director |

| Nor Azlan Bin Zainal | Independent Non-Executive Director |

| Prof. Wang Hong | Independent Non-Executive Director |

| Wan Adli Ridzwan Bin Wan Hassan | Independent Non-Executive Director |

| Syed Mohd Hafiz Bin Syed Mohd | Independent Non-Executive Director |

3.3.2 The Board members must have balance diversity which comprises the requisite knowledge, experience, skills, competence, race, culture and gender.

3.3.3 The Board is the Company’s decision-making body. It is therefore imperative that the Board should be sized in a manner most effective to facilitate decision-makings and deliberation processes.

3.3.4 The Board comprises Directors who as a group provides core competencies such as accounting or finance, business or management experience, industry knowledge, strategic planning experience and customer-based experience or knowledge.

3.3.5 A strong and independent element on the Board should be present to exercise independent objective judgment on the corporate affairs of the Company. No individual or small group of individuals should be allowed to dominate the Board’s decision-making process.

3.3.6 In addition to ensuring the existence of an independent element, consideration is given to the characteristics of each Board member such as business acumen, skills, business background and experience, forming the dynamics of the Board.

3.3.7 The codes of Corporate Governance recommend that this strong and independent element of the Board should consist of Independent Directors making up at least 1/3 of the Board. The tenure of an independent director should not exceed a cumulative term of 9 years.

3.3.8 At any one time, at least two (2) or one-third (1/3), whichever is higher, of the Board members are Independent Directors.

3.3.9 The Board may appoint a Senior Independent Director to whom shareholders’ concerns can be conveyed if there are reasons that contact through the normal channels of the CEO/MD have failed to resolve them. Dr. Tou Teck Yong has been appointed the Senior Independent Director of the Company.

3.3.10 Profiles of Board members are included in the Annual Report of the Company.

3.4 Appointments

3.4.1 The appointment of a new Director is a matter for consideration and decision by all members of the Board upon appropriate recommendation from the Nomination Committee.

3.4.2 The Company Secretary has the responsibility of ensuring that relevant procedures relating to the appointments of new Directors are properly executed.

3.4.3 The Company has adopted educational/training programmes to update the Board in relation to new developments pertaining to the laws and regulations and changing commercial risks which may affect the Board and/or the Company.

3.4.4 In addition to the Mandatory Accredited Programme (MAP) as required by the Bursa Malaysia Securities Berhad, Board members are also encouraged to attend training programmes conducted by highly competent professionals and which are relevant to the Company’s operations and business. The Board will assess the training needs of the Directors and disclose in the Annual Report the trainings attended by the Directors.

3.4.5 The directorships held by any Board member at any one time shall not exceed five (5) in listed companies.

3.5 Re-election/Re-appointment

3.5.1 1/3 of Directors are subject to retirement by rotation yearly or at the interval of every 3 years.

3.5.2 Directors who are over 70 years of age are subject to re-appointment pursuant to S129(6) of the Companies Act, 1965.

3.6 Supply of Information

3.6.1 The Company aims to provide all Directors with timely and quality information and in a form and manner appropriate for them to discharge their duties effectively.

3.6.2 The management is responsible for providing the Board with the required information in an appropriate and timely manner. The CEO/Managing Director, assisted by the Company Secretary, assesses the type of information required to be provided to the Board. If the information provided by the management is insufficient, the Board will make further enquiries where necessary to which the persons responsible will respond as fully and promptly as possible.

3.6.3 A full agenda and comprehensive Board papers are circulated to all Directors well in advance of each Board meeting.

3.6.4 Amongst others, the Board papers include the following:-

(a) Quarterly financial report of the Company;

(b) Minutes of meetings of all Committees of the Board;

(c) A current review of the operations of the Company;

(d) Reports on Related Party Transactions;

(e) Directors’ and Substantial Shareholders’ share-dealings; and

(f) Annual Management Plans/Budget reports.

3.6.5 Minutes of each Board meeting are kept by the Company Secretary and are available for inspection by any Director during office hours.

3.7 Types of Directors

3.7.1 Independent Director

An “independent” director is one who does not have a relationship with the Company, its related Companies or its officers, that could interfere, or be reasonably perceived to interfere, with the exercise of the Director’s independent business judgment.

The Listing Requirements of Bursa Malaysia Securities Berhad prescribes strict guidelines for the classification of “independent directors”, signalling the importance of independent judgment within the Board of public listed companies.

3.7.2 Executive Director

A director who is employed full-time to run the Company’s business and is involved in its management activities is typically known as Executive Directors. They are therefore not independent to the Board. Examples of different categories of Executive Directors are:-

(a) Executive Director; and

(b) CEO/MD.

3.7.3 Non-Executive Director

Although the Non-Executive Director is present at Board meetings of the Company, he is not involved in the day-to-day running of business nor the managing of the business generally. He would therefore, normally not be in the office.

Nevertheless, Non-Executive Directors, together with the Executive Directors, play a part in:-

(a) constructively challenging and helping develop on the Company’s strategy; and

(b) reviewing and monitoring the performance of management.

Note: A Non-Executive Director may not necessarily be an independent director.

4. NON-EXECUTIVE CHAIRMAN AND CHIEF EXECUTIVE OFFICER / MANAGING DIRECTOR (CEO/ MD)

The Company aims to ensure a balance of power and authority between the Non-Executive Chairman and the CEO/MD with a clear division of responsibility between the running of the Board and the Company’s business respectively. The positions of Independent Non-Executive Chairman and CEO/MD are separated and clearly defined.

4.1 Independent Non-Executive Chairman

The Independent Non-Executive Chairman is responsible for leadership of the Board in ensuring the effectiveness of all aspects of his role. Decisions of the Board are made collectively during Board meetings. In order to ensure that meetings are properly facilitated, and the Board properly led, the Chairman plays a crucial and pivotal leadership role in ensuring that the Board works effectively. Additionally, the Chairman of the Board is usually the presiding Chairman during General Meetings of the Company.

Chairman of the Board endeavours to create an environment which promotes constructive deliberations leading to effective contributions by each Board member during Board meetings. Further, the Chairman must be able to manage personal conflicts and help to focus the Board on what really matters as oppose to simply ploughing through the agenda.

The Chairman is responsible for the following:-

(a) Provide leadership and run the Board effectively with the assistance of the Board Committees and management;

(b) Ensure the whole Board plays a full and constructive part in developing and determining the Group’s strategy and overall business and commercial objectives;

(c) Ensure the Board annually reviews its performance and its balanced so as to achieve its effectiveness;

(d) Review the performances of individual Directors;

(e) Supply vision of the Group;

(f) Setting the Board meeting agenda for consideration, giving emphasis on important issues challenged by the Group with emphasis on strategic, rather than operational issues;

(g) Chairing of general meetings and Board meetings;

(h) Act as the Group’s representative in its dealing with external parties;

(i) Help guide the Group on long term strategic opportunities and represent the Group with key industry, civic and philanthropic constituents; and

(j) Promote the highest standards of integrity, probity and corporate governance in the Group.

4.2 CEO/MD

CEO/MD is responsible to the Board for the day-to-day management of the Company and for fulfilling all policy matters set by the Board. These are expounded below.

CEO/MD leads the management team. The Board holds the CEO/MD accountable for the performance of the management team.

The key roles of the CEO/MD are:-

(a) Manage the Group’s business and ensure that operational planning and control systems are in place;

(b) Accountable and responsible for the Group’s operations and financial performance;

(c) Lead management and employees and express his clear leadership;

(d) Prepare and implement strategic plans;

(e) Submit and implement acquisition/investment proposals;

(f) Develop an organizational structure with the necessary succession planning;

(g) Promote communications internally and externally for the Group as the chief communicator by monitoring the goals, visions, missions and challenges;

(h) Maintain a friendly environment and develop organization culture, values and reputation in its markets;

(i) Have a good corporate social responsibility program for shareholders, staff, customers, suppliers, partners and regulatory/official bodies;

(j) Ensure the executive team implements the decisions of the Board and its Committees;

(k) Assist the Chairman in drawing up the agenda for Board meetings by providing input in relation to important strategic issues facing the business;

(l) Highlight and update to the Chairman on complex and sensitive issues that might affect the Company and/or Group and maintaining a consistent dialogue with the Chairman of the Board; and

(m) To lead the group to meet its vision & mission.

5. BOARD COMMITTEES

5.1 To assist the Board in fulfilling its duties and responsibilities, the Board has established the following Committees:-

(a) Audit Committee;

(b) Remuneration Committee;

(c) Nomination Committee; anda

(d) ESOS Committee.

5.2 Most of the Committees have Terms of Reference which have been approved by the Board.

5.3 The Board can establish ad hoc Committees.

6. GENERAL MEETINGS

6.1 Annual General Meeting (AGM)

6.1.1 The Company regards the AGM as an important event in the corporate calendar of which all Directors and key senior executives should attend.

6.1.2 The Company regards the AGM as the principal forum for dialogue with shareholders and aims to ensure that the AGM provides an important opportunity for effective communication with, and constructive feedback from, the Company’s shareholders.

6.1.3 The Chairman encourages active participation by the shareholders during the AGM.

6.1.4 The Chairman and, where appropriate, the CEO/MD responds to shareholders’ queries during the meeting. Where necessary, the Chairman will undertake to provide a written answer to any significant question that cannot be readily answered at the meeting.

6.2 Extraordinary General Meeting (EGM)

The Directors will consider requisitions by shareholders to convene an EGM or any other urgent matters requiring immediate attention of the Company.

7. INVESTOR RELATIONS AND SHAREHOLDER COMMUNICATION

7.1 The Board acknowledges the need for shareholders to be informed of all material business matters affecting the Company and as such adopts an open and transparent policy in respect of its relationship with its shareholders and investors.

7.2 The Board ensures the timely release of financial results on a quarterly basis to provide shareholders with an overview of the Company’s performance and operations in addition to the various announcements made during the year.

7.3 A press interview will be held on ad hoc basis whereby the CEO/MD will give a press release stating the Company’s results, their prospects and outline any specific event for notation.

7.4 The Company’s website provides easy access to corporate information pertaining to the Company and its activities and is continuously updated.

8. RELATIONSHIP WITH OTHER STAKEHOLDERS

In the course of pursuing the vision and mission of the Company, the Board recognizes that no Company can exist by maximising shareholders value alone. In this regard, the needs and interests of other stakeholders are also taken into consideration.

It is the Company’s accountability to integrate responsible ethical practices into all aspects of the business operations to ensure that long-term sustainability of business or the Company would not survive.

The Company encourages the practice of high ethical standards and upgrade of the level of Corporate Conduct to cover 4 main criteria as follows:-

8.1 Market Place

8.1.1 The Company is committed to uphold the corporate responsibility practices and to enhance the economic responsibilities by creating a good return to safeguard its shareholders’ investment.

8.1.2 The Company is responsible to strive to develop and provide products and services which offer value in terms of price, quality, safety and environmental impact.

8.1.3 The Company acknowledges the importance of good corporate governance and ensure the adherence to the MCCG and to comply with all listing requirements, rules and regulations.

8.2 Work Place

8.2.1 The Company acknowledges that the employees are invaluable assets and play a vital role in achieving the vision and mission of the Company.

8.2.2 The Company adopts comprehensive and documented policies and procedures with respect to the following:-

a) Occupational safety and health with the objective of providing a safe, conducive and healthy working environment for all employees; and

b) Industrial relations with the objectives of managing employees’ welfare and well-being in the workplace.

8.3 Environment

8.3.1 The Company acknowledges the need to safeguard and minimise the impact to the environment in the course of achieving the Company’s vision and mission.

8.3.2 The Company adopts comprehensive and documented policies and procedures as part of its commitment to protect the environment and contribute towards sustainable development.

8.3.3 The Company supports initiatives on environmental issues.

8.4 Community

8.4.1 Company shall play a vital role in contributing towards the welfare of the community in which it operates.

8.4.2 The Company supports charitable causes and initiatives on community development projects.

9. COMPANY SECRETARY

9.1 The Board appoints the Company Secretary, who plays an important advisory role, and ensures that the Company Secretary fulfils the functions for which he/she has been appointed.

9.2 The Company Secretary is accountable to the Board through the CEO/MD on all governance matters.

9.3 The Company Secretary is a central source of information and advice to the Board and its Committees on issues relating to compliance with laws, rules, procedures and regulations affecting the Company.

9.4 The Company Secretary should advise Directors of their obligations to adhere to matters relating to:-

(a) Disclosure of interest in securities;

(b) Disclosure of any conflict of interest in a transaction involving the Company;

(c) Prohibition on dealing in securities; and

(d) Restrictions on disclosure of price-sensitive information.

9.5 The Company Secretary must keep abreast of, and inform, the Board of current governance practices.

9.6 The Board members have unlimited access to the professional advice and services of the Company Secretary.

Whistle Blowing Policy and Procedures

1. Introduction

In order to ensure and demonstrate commitment to efficient and independent handling of employee and stakeholder concerns, Mikro MSC Berhad (“Mikro” or “the Company”) has engaged BDO Governance Advisory to set up and administer its Whistle-Blower facilities.

2. Definition

In this Standard Operating Procedure (“SOP”), expressions used shall have meanings shown below:

| Mikro | Mikro MSC Berhad |

| BDO | BDO Governance Advisory Sdn Bhd |

| WB | Whistle-blowing |

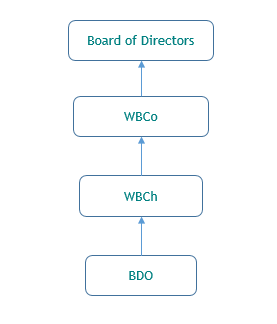

| WBCh | Whistle-Blowing Champions, appointed to manage whistle-blower’s complaints/concerns, comprising the following members: Managing Director (“MD”)Finance Manager (“FM”)Executive Director/Chief Technology Officer (“CTO”) |

| WBCo | Whistle-Blow Committee, consisting selected members from the Board of Directors of Mikro |

| Board | Board of Directors of Mikro |

(Refer to Appendix I for the names of the WBCh, the WBCo and the Board)

3. Objective of this Policies and Procedures

This document sets out the procedures involved in, and the relevant provisions for, whistle-blowing. The whistle-blowing mechanism provides an avenue for concerned parties/stakeholders to raise their concerns about malpractices/improper conduct in a confidential manner and for the execution of inquiries into the reported concerns. This will ultimately drive reporting to the appropriate channels for further actions to be deliberated (if any).

4. Scope of this Policies and Procedures

This document is designed to enable concerned parties/stakeholders to report any perceived act of malpractice/improper conduct. Such reports should not be based on mere speculation, rumors and gossip, but on knowledge of facts. Reportable malpractice/improper conduct covered under this SOP include, but are not limited to:

- All forms of financial malpractice or impropriety such as fraud against the company, fraud by the company, corruption, bribery, theft, embezzlement;

- Financial reporting irregularities;

- Failure to comply with legal and regulatory obligations;

- Breach of contractual obligations to clients/suppliers;

- Any form of criminal activity;

- Misuse of Company’s property;

- Abuse of power;

- Non-disclosure/conflict of interest;

- Breach of Personal Data Protection Act (“PDPA”)

- Discriminatory practices in relation to age, disability, national origin, race/colour, religion, etc.;

- Actions detrimental to Health and Safety or the Environment; and

- Attempt to conceal any of the above listed acts.

In reporting malpractice/improper conduct, the concerned parties/stakeholders should exercise sound discretion. Matters that can be resolved through normal escalations channels by, for example, carrying out internal discussions, reporting to the Head of Human Resources, Head of Finance, or any other/respective department heads, etc., should be addressed in these manners in the first instance. The whistle-blowing mechanism should only be used as a channel to report matters that either cannot be escalated through the normal channels or where such escalation has failed to yield appropriate and adequate action. Notwithstanding, where the concerned parties/stakeholders are in doubt, they should proceed to report through the whistle-blowing channel.

5. Roles and responsibilities

| Party | Roles and Responsibilities |

| BDO |

BDO shall review and handle the concerns confidentially and promptly, and shall report to the WBCh/WBCo/the Board at the following intervals:

|

| Whistle-Blower | Whistle-Blowers are expected to act in good faith and should not make false accusations when reporting their concern(s). |

| WBCo | The WBCo is to oversee the integrity, independence and effectiveness of whistle-blowing processes |

| WBCh | The WBCh are the drivers of any further investigative work. They will receive whistle-blow reports from BDO and review them. WBCh will carry out/instruct for the carrying out either by Mikro’s personnel or an external party, whichever is deemed appropriate, further inquiries or investigation into reported concerns. Where deemed necessary by other related Policies and Procedures of Mikro, the WBCo’s and/or the Board’s approval may be obtained for decisions to be taken. |

| Management (employees of Mikro and including the Board of Mikro) | Management is responsible for making management decisions in relation to all whistle-blowing matters, including accepting responsibility for the results. BDO will not in any way be involved with the management and decision-making functions or normal operations of Mikro. |

6. Whistle/blowing procedures and reporting hierarchy

In order to maintain the independence and integrity of the whistle-blowing process, the following procedures will be adopted:

- Whistle-Blowers shall report their concerns at BDO EthicsLine whistle-blower platform (“EthicsLine”) at Hyperlink >> Mikro Whistleblowing Platform

- Under normal circumstances, the reporting hierarchy of concerns is shown as follows:

- Any concerns received by BDO at EthicsLine will be escalated to the WBCh. The WBCh will follow up/investigate/or at their discretion, delegate the work to internal/external parties(s) as they see fit.

- Where concerns received involve any members in the WBCh other than the MD, the MD will follow up/investigate/or at his discretion, delegate the work to internal/external parties(s) as he sees fit. No detail of the concerns or the identity of the Whistle-Blower will be given to the subject WBCh member(s).

- Where concerns received involve the MD in the WBCh, BDO will escalate the concerns received directly to the WBCo, and the WBCo will follow up/investigate/or at their discretion, delegate the work to internal/external parties(s) as they see fit. No detail of the concerns or the identity of the Whistle-Blower will be given to the MD.

- Where concerns received involve the WBCo, BDO will escalate the concerns received to the WBCh. The WBCh will follow up/investigate/or at their discretion, delegate the work to internal/external parties(s) as they see fit. The MD within the WBCh who has direct access to the Board shall report to the Board directly. No detail of the concerns or the identity of the Whistle-Blower will be given to the WBCo member(s).

- Where concerns received involve any Member of the Board, BDO shall exercise its professional judgement in seeking out appropriate other Members of the Board to ensure the appropriate reporting and follow up to the concerns raised. No detail of the concerns or the identity of the Whistle-Blower will be given to the Board Member in question.

7. Protection to Whistle-Blowers

The identity of Whistle-Blowers will be kept confidential to a reasonably practical extent (see also Section 9 below). All Whistle-Blowers who have acted in good faith will be protected from unfair treatment or practices including, but not limited to:

- Retaliation;

- Threat or intimidation of termination/suspension of service;

- Disciplinary action;

- Transfer;

- Demotion;

- Withholding of promotion; and

- Any direct or indirect use of authority to obstruct the employee’s right to continue to perform his/her duties/functions, including making further disclosures.

Such protection will continue to apply even if investigation later reveals that the Whistle-Blower has been mistaken on facts, and the relevant rules and procedures involved. However, if an employee raises a concern frivolously, maliciously or for personal gain, these protections will no longer apply, and disciplinary action may be taken against the employee.

8. Confidentiality

Notwithstanding the use by BDO and the management, all reported concerns will be treated in confidentiality and are to be kept protected against any unauthorised use and access, except where applicable laws requires its disclosures or where prior adequate notification has been given to the Whistle-Blower.

9. Anonymity of Whistle-Blower

Whistle-Blowers may choose not to disclose his/her identity when reporting their concerns. However, in the course of any resultant investigation (and/or legal proceedings where necessary), the Whistle-Blower may be requested to disclose his/her identity. It should be noted that there will be situations in which further action (including investigation, disciplinary action and/or legal proceedings against the subjects of a complaint) may not be possible without knowing the identity of the whistle-blower.

10. Actions by Management

Once management has received the whistle-blower reports from BDO, management will carry out its investigation and take the appropriate corrective and/or disciplinary actions. Where management has decided that it cannot perform the necessary investigation, due to technical limitations, independence issues or otherwise, management shall engage an independent professional party to carry out the investigation.

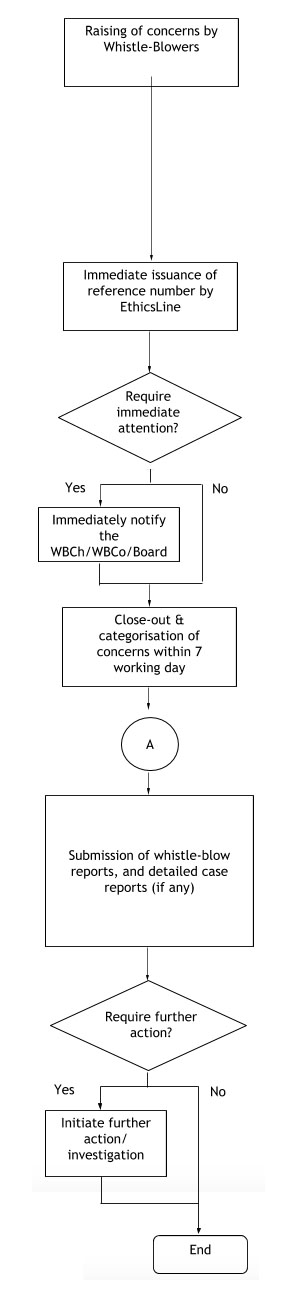

11. Whistle Blowing Procedures

| Process | Narration | ||||

|

Whistle-Blowers are to raise concerns through EthicsLine at Mikro Whistleblowing Platform The concerns should be clearly presented and contain the following details which should be filled-in in the space provided in EthicsLine.

Upon the submission of the concerns, an auto-generated reference number will appear on screen. Whistle-Blowers should save this reference number for checking of status of the concerns lodged on EthicsLine. Where the matter requires immediate attention, BDO shall highlight to WBCh/WBCo/the Board for the next course of action. (i.e. immediate issuance of detailed case report) BDO shall, within 7 working days of the receipt of the concerns, review, categorise, close out the concerns with the Whistle-Blower (subject to Whistle-Blower’s availability and co-operation), and update the status of the concerns on EthicsLine (of which the Whistle-Blower can check). BDO shall submit the whistle-blower reports, i.e. the summary of concerns and the detailed case reports (if any) and status to the following and according to the timeline set out below:

The WBCh/WBCo/the Board of MIKRO shall engage in deliberation on the need for further actions, e.g.: investigations, legal actions, process improvement, disciplinary measures etc. BDO will provide its recommendations on further action and may be requested to join the deliberations. To carry out the further actions internally or eternally, depending on factors such as technical capabilities, independence, confidentiality, etc. |

APPENDIX I

Whistle Blow Champions (WBCh) – Senior Management Personnel

| No. | Position | Name |

| 1 | Managing Director | Yim Yuen Wah |

| 2 | Executive Director/Finance Manager | Goh Yoke Chee |

Whistle Blow Committee (WBCo) – Independent Non-Executive Directors

| No. | Position | Name |

| 1 | Independent Non-Executive Director | Nor Azlan Bin Zainal |

| 2 | Independent Non-Executive Director | Prof. Wang Hong |

| 3 | Independent Non-Executive Director | Wan Adli Ridzwan Bin Wan Hassan |

| 4 | Independent Non-Executive Director | Syed Mohd Hafiz Bin Syed Mohd |

Members of the Board of Director of MIKRO

| No. | Position | Name |

| 1 | Non-Independent Non-Executive Chairman | Datuk Aznam Bin Mansor |

| 2 | Managing Director | Yim Yuen Wah |

| 3 | Executive Director | Goh Yoke Chee |

| 4 | Non-Independent Non-Executive Director | Michael Aw Ming Han |

| 5 | Independent Non-Executive Director | Nor Azlan Bin Zainal |

| 6 | Independent Non-Executive Director | Prof. Wang Hong |

| 7 | Independent Non-Executive Director | Wan Adli Ridzwan Bin Wan Hassan |

| 8 | Independent Non-Executive Director | Syed Mohd Hafiz Bin Syed Mohd |

Terms of Reference for Remuneration Committee

1. Objective

The primary objective of the Remuneration Committee (“Committee”) is to establish a documented, formal and transparent procedure for assessing and reviewing the remuneration packages of Executive Directors and Non-Executive Directors, linking the rewards to corporate and individual performance.

2. Composition

The members of the Committee shall be appointed by the Board from amongst the Directors of the Company and shall comprise of at least three (3) members, consisting wholly or mainly of Independent Non-Executive Directors. The Committee shall elect a Chairman from among its members.

No alternate director shall be appointed as a member of the Committee. The term of office and performance of the Committee and each of its members shall be reviewed by the Board annually to determine whether the members have carried out their duties in accordance with their terms of reference.

If a member of the Committee resigns or for any other reason ceases to be a member with the result that the number of members is reduced to below three (3), the Board shall, within three (3) months from the date of that event, appoint such number of new members as may be required to make up the minimum number of three (3) members.

3. Authority

i) The Committee is authorised to seek any information it requires from any employee of the Company in order to perform its duties.

ii) The Committee is authorised to call for any appropriate person or person to be in attendance to make presentations or furnish or provide independent advice on any matters within the scope of responsibilities.

iii) The Committee is authorised by the Board to obtain, at the Company’s expense, external legal or other professional advice on any matters within its terms of reference.

4. Duties and Responsibilities

i) The Committee shall review and recommend to the Board the framework of remuneration of the Executive Directors and Principal Officers, taking into account the performance of the individual, the inflation price index and information from independent sources on the rates of salary for similar jobs in selected group of comparable companies.

ii) The Committee shall review and determine the annual salary increment, performance bonus, and short term/long term incentives (including share grant and bonus) for Executive Directors and Principal Officers depending on various performance measurements of the Group.

iii) The Committee shall review and determine the other benefits in kind for the Executive Directors.

iv) The Committee shall review the Group’s compensation policy and ensure alignment of compensation to corporate performance, and compensation offered in line with market practice.

v) The Committee may recommend the engagement of external professional advisors to assist and/or advise the Committee and the Board, on remuneration matters, where necessary.

vi) The Committee shall provide a report summarising its activities for the year in compliance with the Malaysia Corporate Governance Code, Listing Requirements and any relevant regulations. The report can be incorporated into the corporate governance statement in the annual report or included as a separate report.

** Subject to shareholders’ approval in the general meeting, the Board as a whole determines the level of remuneration of the Non-Executive Director of the Company. The review of the remuneration of the Non-Executive Director should take into consideration fee levels and trends for similar positions in the market, time commitment required from the director and any additional responsibilities undertaken such as a director acting as chairman of a board committee or as the senior independent non-executive director. The individuals concerned should abstain from discussion of their own remuneration.

5. Meetings of the Committee

The Committee shall meet at least once a year and as frequently as may be required.

In the event the elected Chairman is not able to attend a meeting, a member of the Committee shall be nominated as Chairman for the meeting.

Subject to the notice and quorum requirements as provided in the Terms of Reference, meeting of the Committee may be held and conducted through the telephone or any communication equipment which allows all persons participating in the meeting to hear each other. A person so participating shall be deemed to be present in person at the meeting and shall be entitled to vote and be counted in a quorum accordingly.

6. Quorum

The quorum for a meeting of the Committee shall consist of not less than two (2) members, of which at least one (1) shall be an Independent Non-Executive Director.

7. Notice of Meetings

Unless otherwise agreed, notice of each meeting confirming the venue, time and date, together with an agenda of items to be discussed, shall be forwarded to each member of the committee, any other person required to attend and all other non-executive directors, no later than seven (7) days before the date of the meeting. Supporting papers shall be sent to committee members and to other attendees as appropriate, at the same time.

8. Secretary and Minutes

The Company Secretary or his nominee or such other persons authorised by the Board shall act as the Secretary of the Committee. The Company Secretary shall record, prepare and circulate the minutes of the meetings of the Committee and ensure that the minutes are properly kept and produced for inspection if required.

9. Circular Resolution

A resolution in writing, signed by a majority of the Committee members present in Malaysia for the time being entitled to receive notice of a meeting of the Committee, shall be as valid and effectual as if it had been passed at a meeting of the Committee duly convened and held. Any such resolution may consist of several documents in like form, each signed by one or more of the members of the Committee.

10. Revision and Updates

This Terms of Reference will be reviewed and updated at least once a year to ensure it remains consistent with the Committee’s objectives and responsibilities.

Terms of Reference for Audit Committee

The following are the terms of reference of the Audit Committee:-

A. Objectives

The Objectives of the Audit Committee is to assist the Board in fulfilling its responsibilities for the accounting and internal control systems, the financial reporting procedures, the audit process and compliance with listing requirements.

B. Composition

a. The composition of the Audit Committee complies with the Listing Requirements, which states as follows:

The Audit Committee must comprise of not fewer than one third (1/3) members.

b. All the Audit Committee members must be Non-Executive Directors with a majority of them being Independent Directors.

c. At least one member of the Audit Committee is a member of the Malaysian Institute of Accountants.

d. The members of the Audit Committee shall elect a Chairman among their number who is an Independent Director.

e. If a member of the Audit Committee resigns, dies or for any other reason ceases to be a member with the result that the number of members is reduced below 3, the Board of Directors shall, within 3 months of that event, appoint such number of new member as may be required to make up the minimum number of 3 members.

C. Chairman

The Chairman of the Committee shall be an independent Director appointment by the Board. He shall report on each meeting of the Committee to the Board.

D. Secretary

The Company Secretary shall be the Secretary of the Committee. The Secretary shall be responsible for keeping the minutes of meetings of the Committee and circulate them to the Committee members and to the other Board members.

E. Meeting and Minutes

The Committee shall convene meetings not less than four times a year and as and when the Audit Committee deems necessary.

A minimum of three (3) members present shall form a quorum, both of whom present shall be Independent Directors. In the event that the Chairman is unable to attend a meeting, a member of the Audit Committee shall be nominated as Chairman of the meeting. The nominated Chairman shall be an independent Director.

The Committee may invite other directors and employees to the meeting to brief the Audit Committee on issues that are incorporated into the agenda.

F. Authority

The Committee is authorised by the Board to:

Investigate any activity within its terms of references and shall have unrestricted access to both the internal and external auditors and to all employees of the Group.

Obtain external legal or other independent professional advice as necessary.

Convene meetings with external auditors excluding the attendance of the other directors or employees of the Company, whenever deemed necessary.

G.Duties and Responsibilities

a. To review and recommend the appointment of both internal and external auditors, the audit fee and any questions of resignation of dismissal including the nomination of person or persons as external auditors.

b. To discuss with the internal and external auditors where necessary, on the nature and scope of audit and to ensure coordination of both internal and external auditors’ findings.

c. To review the quarterly results and year-end financial statement prior to the approval by the Board, focusing on:- • going concern assumption; • compliance with the latest accounting standards and statutory and regulatory disclosure requirements; • any changes in accounting policies and practices; • significant adjustments arising from the audit.

d. To review the adequacy of the scope, functions, competency and resources of the internal audit function and that it has the necessary authority to carry out its work.

e. To discuss problems and reservations arising from the interim and final external audits, and any matters the external auditors may wish to discuss (in the absence of management where necessary).

f. To review the external auditors’ management letter and management response, audit plan and Auditor’s Report.

g. To review any related party transaction and conflict of interest situation that may arise within the Company including any transaction, procedure or course of conduct that raises questions of management integrity.

h. To review ESOS allocation.

i. To carry out such other responsibilities, functions or assignments, as may be defined jointly by the Audit Committee and the Board of Directors from time to time.

Terms of Reference for Nominating Committee

1. Objective

The primary objective of the Nominating Committee (“Committee”) is to establish a documented, formal and transparent procedure to support and advise the Board of Directors (“Board”) in fulfilling their responsibilities to shareholders in ensuring the Board are comprised of individuals with an optimal mix of qualifications, skills and experience.

2. Composition

The members of the Committee shall be appointed by the Board from amongst the Directors of the Company and shall comprise of at least three (3) members, all of whom must be Non-Executive Directors, with a majority of them being independent.

The Committee shall elect a Chairman from among its members and the elected Chairman shall be an Independent Non-Executive Director.

No alternate director shall be appointed as a member of the Committee. The term of office and performance of the Committee and each of its members shall be reviewed by the Board annually to determine whether the members have carried out their duties in accordance with their terms of reference.

If a member of the Committee resigns or for any other reason ceases to be a member with the result that the number of members is reduced to below three (3), the Board shall, within three (3) months from the date of that event, appoint such number of new members as may be required to make up the minimum number of three (3) members.

3. Authority

i) The Committee is authorised to seek any information it requires from management of the Company in order to perform its duties.

ii) The Committee is authorised to call for any appropriate person or person to be in attendance to make presentations or furnish or provide independent advice on any matters within the scope of responsibilities.

iii) The Committee is authorised by the Board to obtain, at the Company’s expense, external legal or other professional advice on any matters within its terms of reference.

4. Duties and Responsibilities

In fulfilling its primary objectives, the Committee shall undertake, amongst others, the following duties and responsibilities:

i. The Committee shall undertake an annual review of the Board’s succession plans, taking into consideration, the present size, structure and composition of the Board and Board Committees as well as the required mix of skills, experience and competency required and make recommendations to the Board with regard to any adjustments that are deemed necessary; ii. The Committee shall give full consideration to succession planning for Directors and other senior executives in the course of its work, taking into account the challenges and opportunities facing the company, and the skills and expertise needed on the Board in the future; The Committee has to facilitate the evaluate the effectiveness of the Board as a whole, the various Committees and each individual Director’s contribution to the effectiveness on the decision making process of the Board; iii. The Committee shall be responsible for identifying and make recommendation to the Board on new candidates for election/appointment to the Board or to fill board vacancies as and when they arise; iv. The Committee shall ensure that orientation and education programmes are provided for new members of the Board; v.The Committee shall recommend to the Board concerning the re-election/re-appointment of Director to the Board pursuant to the provisions in the Company’s Article of Association; In determining the process for the identification of suitable candidates, the Committee will ensure that an appropriate review is undertaken to ensure the requirement and qualification of the candidate nominated based on a prescribed set of criteria comprising but not limited to the following:

Skills, knowledge, expertise and experience;

Professionalism;

Integrity;

Existing number of directorships held;

Confirmation of not being an undischarged bankrupt orinvolved in any court proceedings in connection with the promotion, formation or management of a corporation or involving fraud or dishonesty punishable on conviction with imprisonment or subject to any investigation by any regulatory authority under any legislation; and

In the case of candidates being considered for the position of independent director, such potential candidates have the ability to discharge such responsibilities/functions as expected from independent non-executive directors. Amongst others, the potential candidates must fulfil the criteria used in the definition of “independent directors” prescribed by the ACE Market Listing Requirements of Bursa Malaysia Securities Berhad and being able to bring independent and objective judgement to the Board.

Where required, the members of the Committee would meet up with potential candidates for the position of director to conduct an assessment of the suitability.

(Note: The Group practices non-discrimination in any form whether based on age, gender, ethnicity or religion throughout the organisation and this includes the selection of directors). vii. The Committee shall undertake an annual review of the training programmes attended by the Directors for each financial year as well as the training programmes required to aid the Directors in the discharge of their duties as Directors and to keep abreast with industry developments and trends; and

viii. The Committee shall provide a report summarising its activities for the year in compliance with the Malaysia Corporate Governance Code, Listing Requirements and any relevant regulations. The report can be incorporated into the corporate governance statement in the annual report or included as a separate report.

5. Meetings of the Commitee

The Committee shall meet at least once a year and as frequently as may be required.

In the event the elected Chairman is not able to attend a meeting, a member of the Committee shall be nominated as Chairman for the meeting. The nominated Chairman shall be an Independent Non-Executive Director.

Subject to the notice and quorum requirements as provided in the Terms of Reference, meeting of the Committee may be held and conducted through the telephone or any communication equipment which allows all persons participating in the meeting to hear each other. A person so participating shall be deemed to be present in person at the meeting and shall be entitled to vote and be counted in a quorum accordingly.

6. Quorum

The quorum for a meeting of the Committee shall consist of not less than two (2) members, majority of members present must be Independent Non-Executive Directors.

7. Notice of Meetings

Unless otherwise agreed, notice of each meeting confirming the venue, time and date, together with an agenda of items to be discussed, shall be forwarded to each member of the committee, any other person required to attend and all other non-executive directors, no later than seven (7) days before the date of the meeting. Supporting papers shall be sent to committee members and to other attendees as appropriate, at the same time.

8. Secretary and Minutes

The Company Secretary or his nominee or such other persons authorised by the Board shall act as the Secretary of the Committee. The Company Secretary shall record, prepare and circulate the minutes of the meetings of the Committee and ensure that the minutes are properly kept and produced for inspection if required.

9. Circular Resolution

A resolution in writing, signed by a majority of the Committee members present in Malaysia for the time being entitled to receive notice of a meeting of the Committee, shall be as valid and effectual as if it had been passed at a meeting of the Committee duly convened and held. Any such resolution may consist of several documents in like form, each signed by one or more of the members of the Committee.

10. Revision and Updates

This Terms of Reference will be reviewed and updated at least once a year to ensure it remains consistent with the Committee’s objectives and responsibilities.

Shareholder Communication and Corporate Disclosure Policy

Director Remuneration Policy

1. Objective

Mikro MSC Berhad (“Mikro”) is committed to remunerating its directors in a manner that is market competitive, consistent with best practice and supports the interests of shareholders. Mikro aims to align the interests of the non-executive directors with those of shareholders by remunerating senior executives through performance and long term incentive plans in addition to their fixed remuneration.

2. Remuneration Components for Managing Director and Executive Directors

The fixed salary is determined according to:

i) The scope of the duty and responsibilities;

ii) The conditions and experiences required;

iii) The ethical values, internal balances and strategic targets of the Company;

iv) The corporate and individual performance; and

v) Current market rate within the industry and in comparable companies.

Bonus:

The bonus in the case of MD and EDs is designed to reward outstanding performance. The bonus is granted to reflect the MD and Executive Directors’ performance as well as Group results.

3. Remuneration for Non-Executive Directors

The fixed fee is determined according to:

i) On par with the rest of the market;

ii) Reflect the qualifications and contribution required in view of the Group’s complexity;

iii) The extent of the duty and responsibilities; and

iv) The number of Board meetings.

4. Other Benefits and Allowances

The benefits and allowances which should be decided by the Board as a whole include:

i) Meeting allowance;

ii) Expenses incurred in the course of their duties as Directors;

iii) Employees Share Option Scheme (“ESOS”) and

iv) Benefit in kind such as motor vehicle, petrol, driver, medical benefits, use of mobile phone and accommodation.

5. Policy Review

The Remuneration Committee will review the Policy periodically to ensure that it continues to remain relevant and appropriate.

Policy on Employement of Former Employees of the External Audit

1. Objective

The policy statement contains the basic guidelines to be followed by company personnel in hiring employees or former employees of the Company’s external auditing firm. The external auditor’s independence could be compromised if the Company were to hire external auditor’s former employees, who could, by reason of their knowledge of and relationships with the external auditor, negatively impact the effectiveness and quality of an audit. A loss of independence could also occur if an employee were to be perceived as being influenced by the prospect of potential employment with the Company of its subsidiaries.

2. General Principle

The Audit Committee establishes the following guidelines for hiring employees or former employees of independent auditors:

i) Key audit partners will not be offered employment by the company or any of its subsidiary undertakings within two years of undertaking any role on the audit;

ii) Other key team members will not be offered employment by any group company within six months of undertaking any role on the audit;

iii) Other audit team members who accept employment by any group company must cease activity on the audit immediately they tender their resignation to the audit firm;

iv) Any offer of employment to a former employee of audit firm, within two years of the employee leaving the audit firm, must be pre-approved by the audit committee where the offer is made in respect of a senior executive position.

3. Policy Implementation

The Finance Manager shall coordinate the implementation of this Policy.

4. Policy Review

This Policy shall be reviewed periodically to ensure that it continues to remain relevant and appropriate.

Policy on External Auditor

1. Objective

The Audit Committee (“the Committee”) of Mikro MSC Berhad (“MIKRO”) is responsible for reviewing, assessing and monitoring the performance, suitability and independence of external auditors. The objective of this External Auditors Policy (“the Policy”) is to outline the guidelines and procedures for the Committee to assess and monitor the external auditors.

2. Selection and Appointment

The Board has delegated to the Committee the responsibility for the appointment, remuneration and removal of external auditor.

Pursuant to Section 172(2) of the Companies Act 1965, the Company shall at each annual general meeting appoint or re-appoint the external auditors of the Company, and the external auditors so appointed shall, hold office until the conclusion of the next annual general meeting of the Company.

Should the Committee determine a need for a change of external auditors, the Committee will follow the following procedures for selection and appointment of new external auditors:-

i) the Committee to identify the audit firms who meet the criteria for appointment and to request for their proposals of engagement for consideration;

ii) the Committee will assess the proposals received and shortlist the suitable audit firms;

iii) the Committee will meet and/or interview the shortlisted candidates;

iv) the Committee may delegate or seek the assistance of the Chief Financial Officer (“CFO”) to perform items (a) to (c) above;

v) the Committee will recommend the appropriate audit firm to the Board for appointment as external auditors; and

vi) the Board of Directors will endorse the recommendation and seek shareholders’ approval for the appointment of the new external auditors and/or resignation/removal of the existing external auditors at the general meeting.

3. Independence

The external auditors are precluded from providing any services that may impair their independence or conflict with their role as external auditors. The Committee shall obtain a written assurance from the external auditors confirming that they are, and have been, independent throughout the conduct of the audit engagement in accordance with the terms of all relevant professional and regulatory requirements.

4. Non-Audit Services

The external auditors can be engaged to perform non-audit services that are not, and are not perceived to be, in conflict with the role of the external auditors. This excludes audit related work in compliance with statutory requirements.

The prohibition of non-audit services is based on three (3) basic principles as follows:-

i) external auditors cannot function in the role of Management;

ii) external auditors cannot audit their own work; and

iii) external auditors cannot serve in an advocacy role of the Company and its subsidiaries (“the Group”).

The external auditors shall observe and comply with the By-Laws of the Malaysian Institute of Accountants in relation to the provision of non-audit services, which include the following:-

i) accounting and book keeping services;

ii) valuation services;

iii) taxation services;

iv) internal audit services;

v) IT systems services;

vi) litigation support services;

vii) recruitment services; and

viii) corporate finance services.

All engagements of the external auditors to provide non-audit services are subject to the approval/endorsement of the Committee.

Management shall obtain confirmation from the external auditors that the independence of the external auditors will not be impaired by the provision of non-audit services.

5. Term of Audit Partner

The audit partner responsible for the external audit of the Group is subject to rotation at least every five (5) financial years.

6. Annual Reporting

The External Auditors shall issue an annual audit plan for review and discussion with the Committee.

The External Auditors shall also provide a management letter to the Committee upon completion of the annual audit.

7. Annual Performance Assessment

The Committee shall carry out annual assessment on the performance, suitability and independence of the external auditors based on the following four (4) key areas:-

i) quality of service;

ii) sufficiency of resources;

iii) communication and interaction; and

iv) independence, objectivity and professional scepticism.

The Committee may also request the Head of Finance to perform the annual assessment of the external auditors.

8. Review

The Committee will review the Policy periodically to ensure that it continues to remain relevant and appropriate.

No Gift Policy

1. Objective

Mikro Msc Berhad (“Mikro”/Company) aims to establish a uniform policy relating to the acceptance of gifts, including gratuities or rewards. This policy applies to all elected and appointed officials, as well as all employees of Mikro.

2. Definitions

“Gift” means any bestowal of money, any item of value, service, loan, thing or promise, discount or rebate for which something of equal or greater value is not exchanged. Payments for travel, entertainment and food are gifts.

“Gift” does not include:

i) Any discount or rebate made in the regular course of business and offered to the general public without regard to the individual’s connection with the Company

ii) Inheritances

iii) Plaques or trophies

iv) Campaign contributions.

3. Policy

i) No gifts of any kind, that are offered by vendors, suppliers, customers, potential employees, potential vendors, and suppliers, or any other individual or organization, no matter the value, will be accepted by any employee, at any time, on or off the work premises. By “gift,” your company means any item including pens, hats, t-shirts, mugs, calendars, bags, key chains, portfolios, and other ornaments as well as items of greater value;

ii) This policy includes vendor or potential vendor or supplier-provided food, beverages, meals, or entertainment that is not extended to any other employees.

iii) This policy includes any business courtesy offered such as a product discount or any other benefit if the benefit is not extended to all employees.

4. Gift Policy Exemptions

i) Exempted from this policy are gifts such as t-shirts, pens, trade show bags and all other ornaments that employees obtain, as members of the public, at events such as conferences, training events, seminars, and trade shows, that are offered equally to all members of the public attending the event;

ii) Exempted are cards, thank you notes, certificates, or other written forms of thanks and recognition;

iii) May accept discounts from suppliers which are of the same discount that is made available to public;

iv) May accept edible gifts of nominal value less than RM500.00 that are shared with a wide range of colleagues at the Company;

v) May accept items that can be displayed in public areas of Company’s building (such as flowers); and

vi) May accept handmade items by and from children under age 16.

5. Procedures

i) Upon being offered or receiving a gift prohibited by this policy, an individual must notify the gift giver of this policy and graciously decline or return the gift; and

ii) If the gift is anonymous, the recipient must deliver the gift to the management, who will convey the gift to a charitable organization.

6. Further Assistance

Any employee who requires assistance with this policy should first consult with their immediate superior. Should further advice be required, the employee should contact the Finance and Admin Manager.

7. Policy Review

This Policy shall be reviewed periodically to ensure that it continues to remain relevant and appropriate.

Grievance Policy and Procedure

Recognising the value and importance of full discussion clearing up misunderstanding and preserving harmonious employer-employee relations, every possible effort shall be made by both the Company and the employee to settle any complaint / grievance as equitable and efficiently as possible

1. What is a Grievance?

A Grievance means a complaint from an employee concerning treatment in a particular workplace that is inequitable or procedurally unfair; or a complaint that arises from perceived personal concerns relating to one or more work-related interpersonal relationships. If more than one employee raises the same or substantially similar grievance(s), then each grievant will be managed separately.

2. Grievance Procedure

2.1 Before entering into the formal process, the aggrieved employee should attempt to resolve grievance with his or her immediate superior.

2.2 Should an employee fail to obtain satisfactory settlement of his /her complain/ grievance from his immediate superior within three (3) working days, the aggrieved may refer his / her grieve to the Management Ms. Goh Yoke Chee who will:

organise for mediation to occur to try and resolve the grievance;

make a relevant determination about the grievance;

investigate the matter to make findings as to whether or not some or all of the grievance is substantiated; or refer the matter to an external investigator to investigate the matter and make findings as to whether or not some or all of the grievance is substantiated.

Any grievance which is not presented within the time limit stipulated or any extension agreed thereof shall be considered as resolved.

2.3 If the grievance is dealt with by formal investigation, the Company will aim to ensure:

Before a grievance is investigated, the grievant relevantly describes the allegations they wish to make (in most instances, but not all, this will need to be in writing), including particulars of the allegations so that they can be investigated appropriately;

The person against whom the allegations are made is provided with a copy of the allegations that will be investigated and provided with the right of response; and

All parties are informed in writing of the outcomes of any investigative process.

3. Outcomes and Referral

3.1 If a grievance is investigated under this Policy and findings are made that substantiate any or all of the allegations made, the Managing Director, Finance and Admin Manager or nominee may refer the matter to the relevant nominated supervisor/delegated officer. The relevant nominated supervisor/Delegated Officer may:

Counsel the staff member involved on their behaviour and the findings made as a result of the investigation;Commence disciplinary action which could lead to disciplinary action being taken, including termination of employment;

Take some other form of appropriate action; or

Take no further action.

4. Confidentiality and Victimisation

4.1 The parties to a grievance are required, at all stages of this policy and procedure, to maintain confidentiality in relation to the concern or compliant. The parties must not disclose, by any form of communication, either the fact or the substance of the matter to anyone.

4.2 A person must not victimise or otherwise subject another person to detrimental action as a consequence of that person raising, providing information about, or otherwise being involved in the resolution of a grievance under these procedures.

4.3 Any breach of either the confidentiality or non-victimisation requirements will be treated seriously by the Company, and may result in disciplinary action. Any such breach will be referred for investigation and handling in accordance with the relevant misconduct procedure.

5. Further Assistance

Any employee who requires assistance with this policy should first consult with their immediate superior. Should further advice be required, the employee should contact the Finance and Admin Manager.

6. Policy Review

This Policy shall be reviewed periodically to ensure that it continues to remain relevant and appropriate.

Code of Conduct and Ethics

1. Objective

Mikro MSC Berhad (“Mikro/Company”) has created this Code of Business Conduct & Ethics to ensure that our employees’ business decisions follow our commitment to the highest ethical standards and law. Adherence to this Code and to our other official policies is essential to maintaining and furthering our reputation for fair and ethical practices among our customers, shareholders, employees, communities and other stakeholders. Working with a strong sense of integrity is critical to maintaining trust and credibility. The Code of Conduct & Ethics is our guide to appropriate conduct. It describes the moral and ethical behaviour that is expected from all employees.

2. Values

i) Fairness

Each employee should endeavour to deal fairly with the Company’s customers, suppliers, contractors, competitors and other employees. No one should take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts, or any other unfair dealing practice.

ii) Integrity

Honesty and open communication are encouraged between employers, employees and co-workers. Employees are to conduct themselves in an orderly and professional manner which will not give rise to serious suspicion about their integrity.

3. Work Environment and Employment

i) Diversity and Respect in the Workplace

Mikro is sincere in its commitment to build a work environment where openness, trust and respect are integral parts of our corporate culture. Employees are expected to treat each other with respect and to value each other’s differences and the diverse perspectives those differences bring. The Company considers harassment and discrimination to be unjust and damaging to our work environment. Employees are expected to obey all existing laws, policies, standards and procedures related to work environment, and to respect fellow colleagues at the workplace.

ii) Equal Opportunity Employment

Our employees are our most valuable assets. The Company’s success depends on attracting and keeping a diverse workforce of talented employees. Every employee will be recognised for their skills, knowledge, experience and performance, which are vital to the growth of the organisation. The Company fully supports all principles of providing equal opportunity in employment.

Immediate family members and partners of employees may be hired as employees or consultants only if the appointment is based on qualifications, performance, skills and experience and provided that there is no direct or indirect reporting relationship between the employee and his or her relative or partner.

These principles of fair employment will apply to all aspects of the employment, including compensation, promotions and transfers, as well as in case that the relationship develops after the respective employee has joined the Company.

4. Company Assets and Information

i) Appropriate Use of Company Assets and Equipment